Adding Tax ID Number for Orders to Brazil and Chile

Ensure smooth order fulfillment to Brazil and Chile by providing the required Tax ID numbers for customs clearance.

Customs regulations require that all parcels entering Brazil and Chile must include a valid Tax ID matching the recipient’s information; otherwise, customs will decline the parcel.

HyperSKU strongly recommends providing Tax IDs for orders to Brazil and Chile to ensure seamless fulfillment. Shipments cannot proceed without a valid Tax ID, and HyperSKU will hold the order until the required information is provided.

Brazil Tax ID Requirements:

1. CPF (Cadastro de Pessoas Físicas) - for individuals:

- Format: 000.000.000-00

2. CNPJ (Cadastro Nacional de Pessoa Jurídica) - for businesses:

- Format: 00.000.000/0000-00

What is the Chile Tax ID?

The tax ID in Chile is called RUT (Rol Único Tributario), which have 8 digits plus a verification digit.

RUT (Rol Único Tributario) - for individuals and businesses:

- Format: 12345678A or 123456789

Get Tax ID from Customers in Brazil and Chile

You must have your customers provide a Tax ID for orders shipping to Brazil and Chile. Passport numbers are NOT accepted as alternatives for Tax IDs.

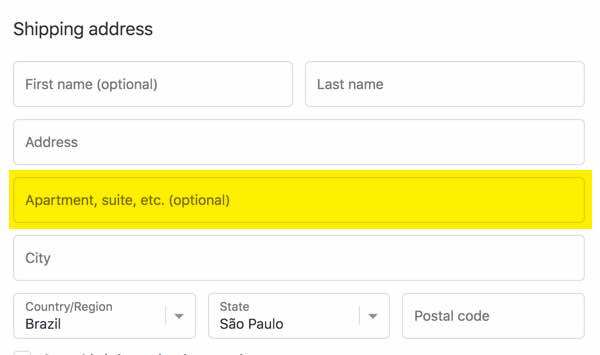

If you haven’t implemented a dedicated field for Tax IDs on your Shopify or WooCommerce checkout page, we suggest asking customers to enter a VALID Tax ID in the "Address Line 2" field.

Adding a reminder on your website or checkout page is also recommended.

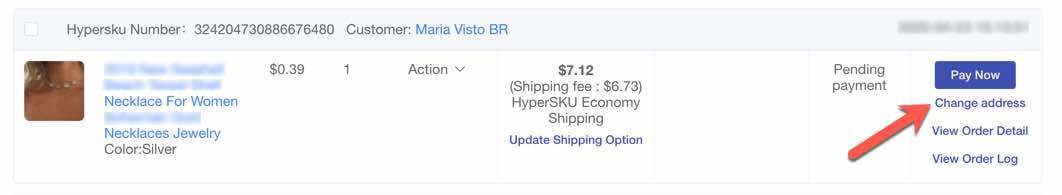

If you receive the customer’s Tax ID after the order is placed and need to update that information in HyperSKU, please modify the shipping address in 'Address 2' on your HyperSKU account’s order page.

The Shopify Team has added additional fields to collect specific information (for example, tax ID) when checking out. Until you implement the field to your store, we suggest you apply above walkaround solution.

If you have any questions or need further assistance, please contact your dedicated HyperSKU agent. The HyperSKU team is always here to help! 😃

![未标题-1-01.png]](https://support.hypersku.com/hs-fs/hubfs/%E6%9C%AA%E6%A0%87%E9%A2%98-1-01.png?height=50&name=%E6%9C%AA%E6%A0%87%E9%A2%98-1-01.png)