Respond to EU VAT rules changes

Learn how EU VAT changes impact your business and how to comply when shipping to the EU.

The European Union (EU) is implementing significant VAT rule changes effective July 1, 2021. HyperSKU is working closely with partners to ensure compliance and smooth dropshipping fulfillment.

What Are the Changes?

- Distance Selling Threshold Withdrawn: VAT rates will be based on the buyer’s country of residence.

- New EU-Wide Threshold for Micro-Businesses: A threshold of €10,000 applies for businesses with sales under this amount in the past two years, allowing them to charge the VAT rate of their own country.

- OSS (One-Stop Shop) System: This simplifies VAT processes by allowing businesses to manage VAT from a single EU member state without multiple registrations.

What does it mean for Shopify sellers?

Starting July 1, 2021:

- Shopify will automatically charge VAT based on the buyer’s shipping country for sales within the EU.

- Sellers must update VAT settings in Shopify and provide a VAT number if serving EU customers.

Policies from Logistics Partners to Comply with New VAT Rules

All HyperSKU users selling to the EU must charge and report VAT using the Import One-Stop Shop (IOSS). All orders shipped by HyperSKU to the EU must include an IOSS number, as logistics partners will not ship parcels without one.

Important Actions for HyperSKU Clients

From June 26, 2021, all orders shipped to EU member countries require an IOSS number for customs clearance. Parcels without IOSS numbers will not be shipped.

Selling to the EU with Your Own IOSS Number

1. Register for IOSS

-

If your business is based in EU, you can register businesses on the IOSS portal of any EU Member State.

-

If your business is not based in EU, you need to appoint an EU-established intermediary to fulfill the VAT obligations under IOSS.

2. Provide IOSS number to HyperSKU

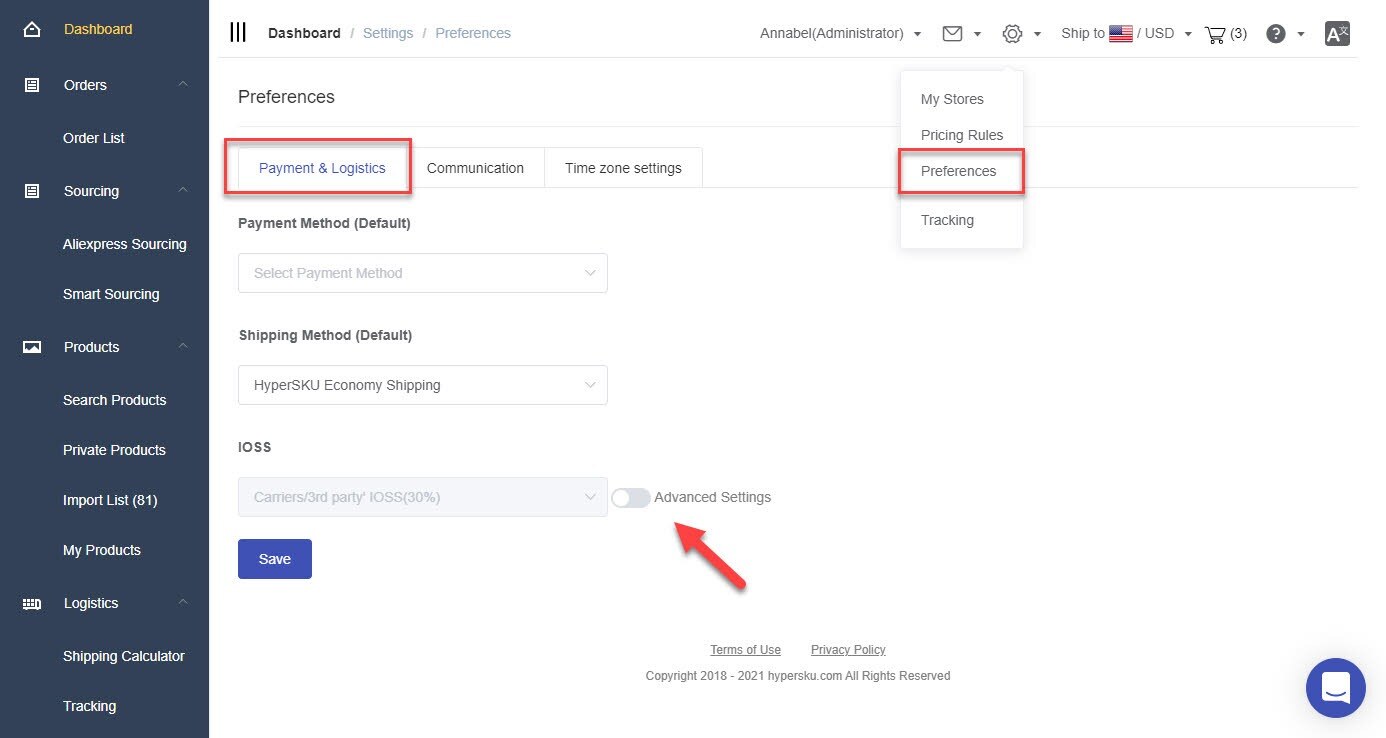

a. Log into your account, go to upper right Settings > Preferences > Payment & Logistics

b. Tick ‘Advanced Setting’. You may set different IOSS number per store. Select store, and make sure to choose ‘EU member states’

c. Enter your IOSS VAT number. Click ‘Save’.

3. File and submit VAT monthly via IOSS

*This applies to all HyperSKU-branded shipping, including HyperSKU Standard Shipping, HyperKU Economy Shipping, HyperSKU Ground Shipping, and HyperSKU Liquid Shipping.

Selling to EU with 3PL’s IOSS number

If you don’t have IOSS number and find it difficult to register for one, HyperSKU can have our logistics partners to be the collector and payer of the required VAT. You need to pay HyperSKU additional 30% of the product cost when paying for the order. This is the default setting and no action is required from your end.

Example: As dropshipper, Jane wants to use the IOSS number of HyperSKU’s 3PL for custom clearance. To fulfill an order to Germany, HyperSKU charges Jane 10 EUR for the product, and 5 EUR for shipping. Then Jane needs to pay extra 10 EUR * 30% = 3 EUR. In total, Jane needs to pay 18 EUR to HyperSKU to fulfill the order.

*This applies to all HyperSKU-branded shipping, including HyperSKU Standard Shipping, HyperKU Economy Shipping, HyperSKU Ground Shipping, and HyperSKU Liquid Shipping.

Selling to EU without IOSS number

If you proceed without an IOSS number, your customer will be required to pay VAT upon the parcel's arrival at customs. This may result in longer processing times and a less satisfactory shopping experience.

ePacket is the only available shipping option for non-IOSS orders. A correct customer address and phone number are mandatory. HyperSKU does not provide refunds or reshipments if the end-customer refuses to pay the VAT.

For more information:

EU Member States OSS Contact Details

The information provided is not intended to offer comprehensive legal or tax advice. Readers should consult a tax professional or local taxation authority for guidance. HyperSKU is neither a marketplace nor a facilitator and is only responsible for conveying relevant information to logistics partners for customs procedures. HyperSKU users are responsible for their own tax obligations and liabilities.

If you have any questions or need further assistance, please contact your dedicated HyperSKU agent. The HyperSKU team is always here to help! 😃

![未标题-1-01.png]](https://support.hypersku.com/hs-fs/hubfs/%E6%9C%AA%E6%A0%87%E9%A2%98-1-01.png?height=50&name=%E6%9C%AA%E6%A0%87%E9%A2%98-1-01.png)